Superannuation changes just passed by the Australian Parliament are the biggest in number since 2007. This video takes the place of a face to face seminar and will cover the following topics:

- Pension Caps of $1.6 Million

- TRIS Tax Free Status

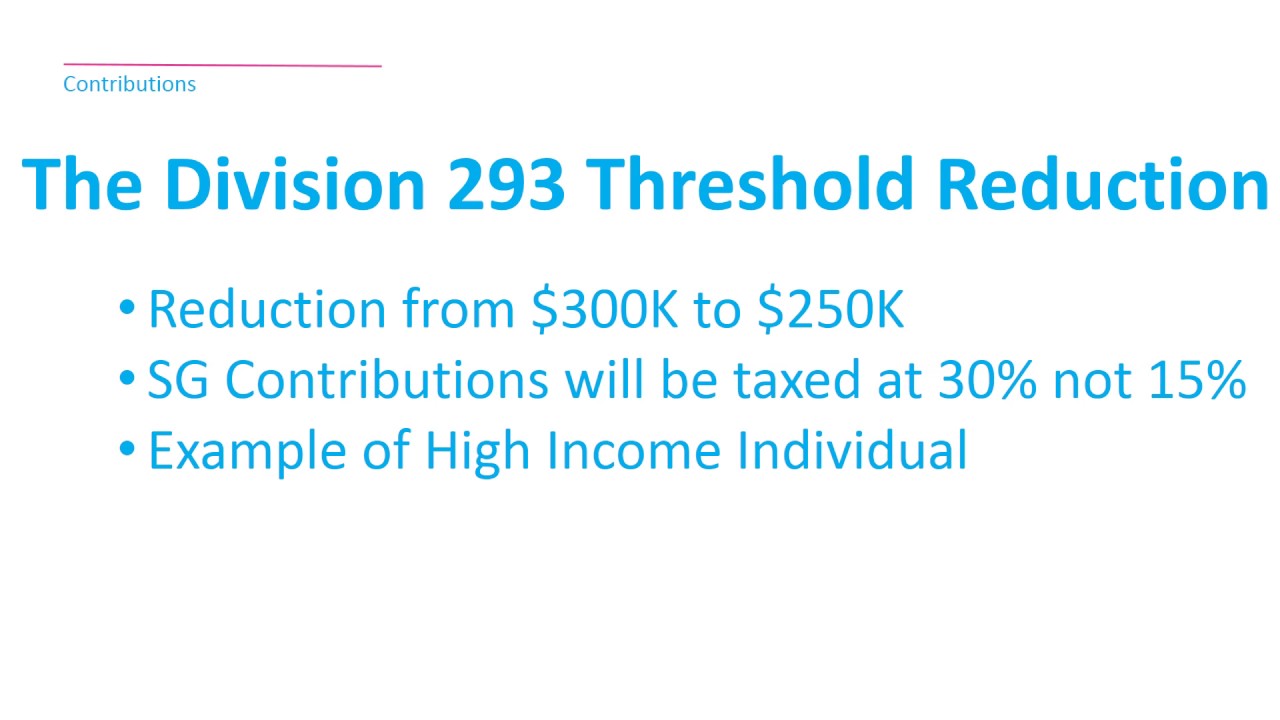

- Changes to Concessional & Non Concessional Contributions

- Low Income Tax Offset

- 10% Self Employed Rule

Even if you think that the changes will not affect you, the video may contain some information that will be helpful. Please enjoy and do not hesitate to contact your adviser or Supervision to discuss on 08 9367 9655 or 1300 693 863. The video is not intended as a substitute for financial advice and is for information purposes only.