How an SMSF works?

How an SMSF Works

How an SMSF Operates After Setup

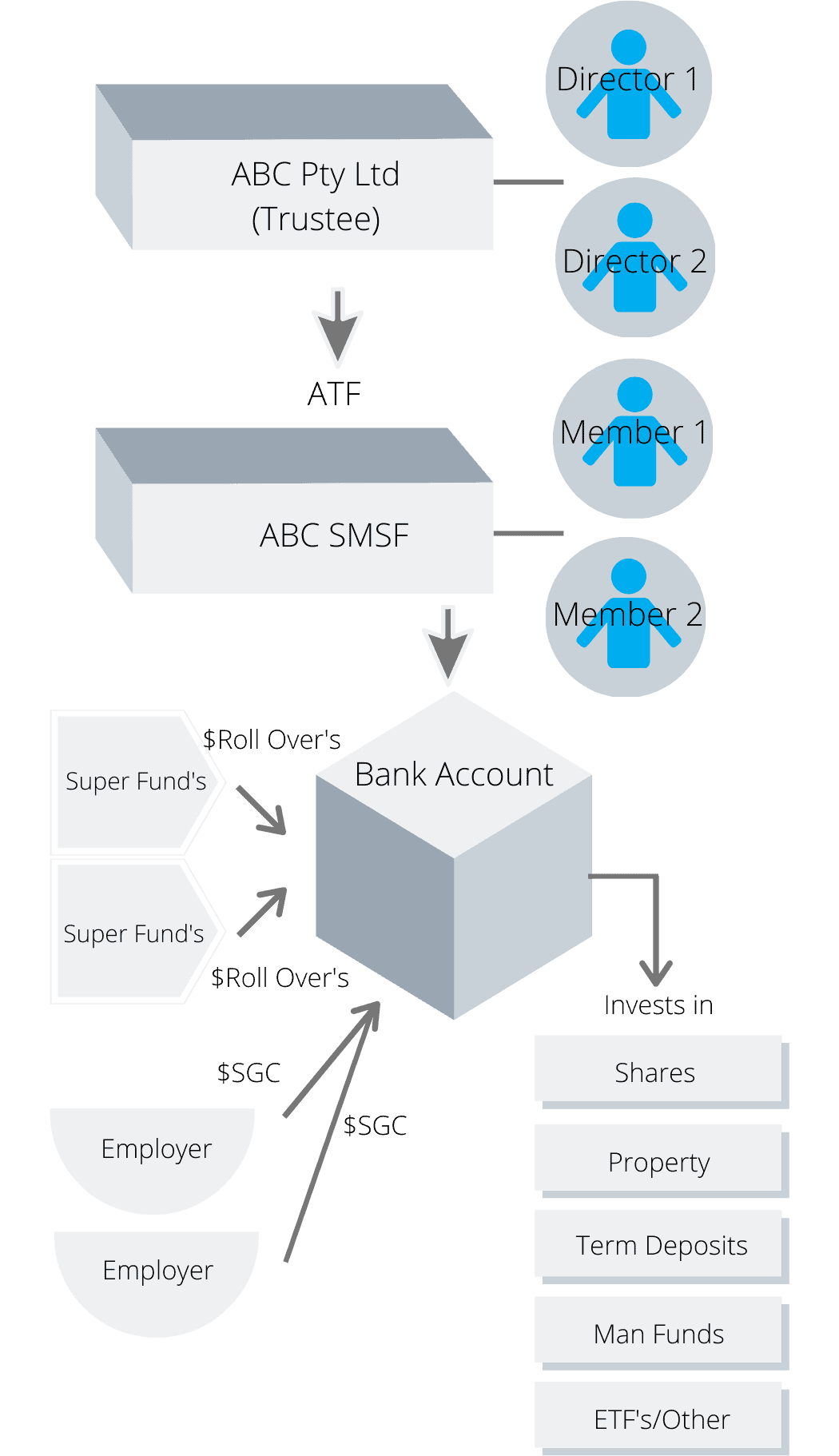

Once your SMSF is established, it becomes a legal structure with investments held in the name of the fund. How the SMSF operates is governed by Superannuation Law and the SMSF Trust Deed—the rules that define what the fund can and cannot do.

After setup, you can choose to have your employer contributions paid directly into your SMSF. This allows you to build up cash within the fund, which can then be invested in a wide range of assets.

All investment income and earnings stay within the SMSF until you reach a condition of release and can legally access your super. Likewise, all investment and operating expenses must be paid by the SMSF itself. Insurance should also be considered as part of your investment strategy, which outlines how the fund will meet its retirement objectives.

Your Investment Strategy

The investment strategy is a compliance document created and maintained by the trustees. It’s essentially the “investment story” of your SMSF and must be reviewed at least once a year. You can create your own investment strategy easily, and we guide you through how to ensure it covers key areas like diversification, liquidity, and risk.

Ongoing Compliance and Reporting

Each year, your SMSF must be audited by a licensed independent auditor, and a tax return must be lodged with the ATO. At Supervision, we take care of these tasks for you by keeping your SMSF up to date throughout the year and compiling all required documents on your behalf.

With compliance handled by our team, you can focus on what matters most – growing your retirement wealth through your investment strategy.