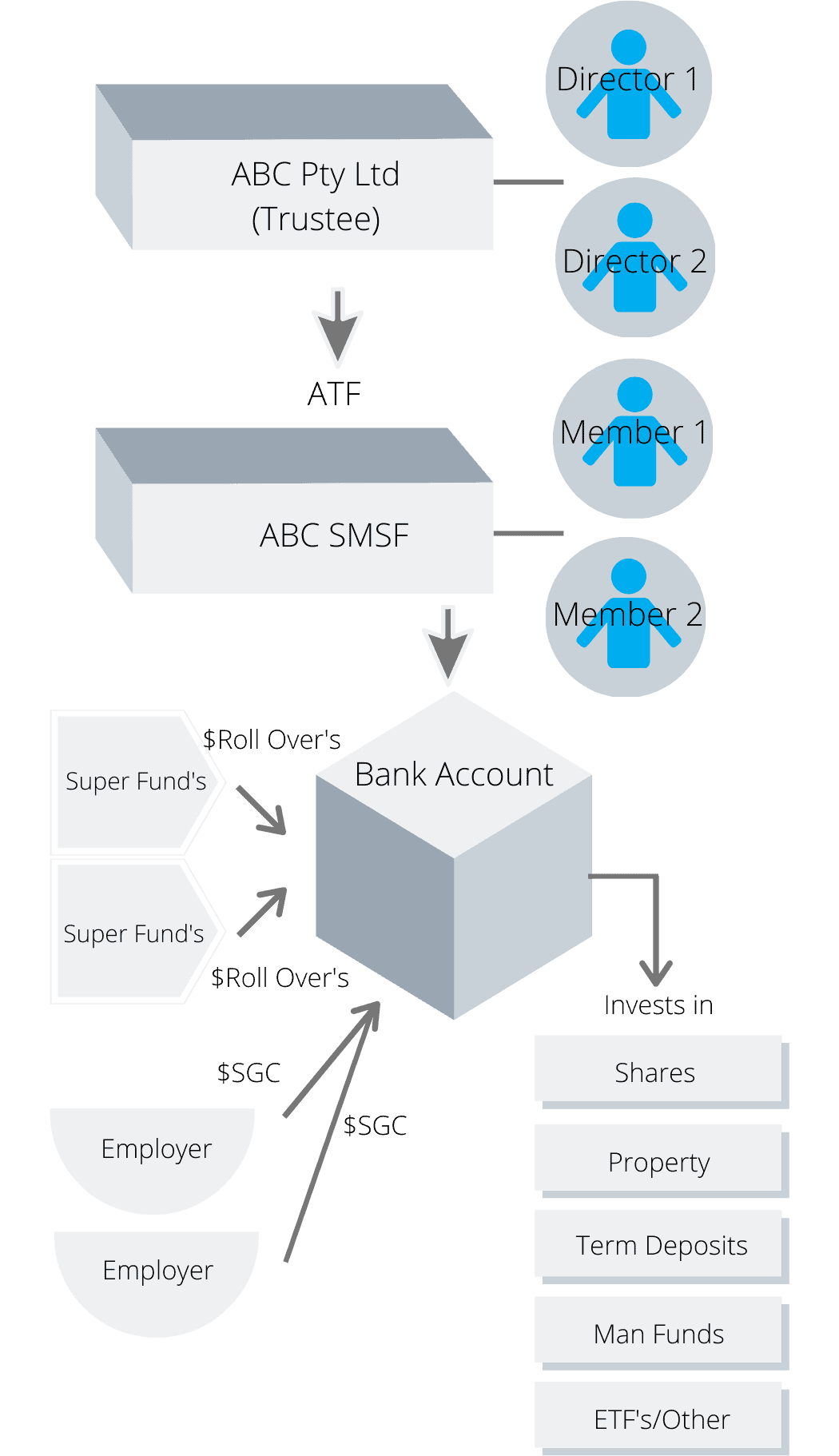

How an SMSF works?

Once created, an SMSF is a bank account with investments in the name of your SMSF. How the SMSF conducts its business is governed by Superannuation Law and the SMSF Trust Deed (SMSF Rules). After establishment, you can elect to contribute your employer contributions to your SMSF and build up cash to invest in other assets. See how it works.

All investment income and earnings are retained in your SMSF until you are able to legally access your money. All investment and other expenses of the SMSF are paid by the SMSF. Insurance must be considered as part of your investment strategy.

Investment Strategies are created and maintained by the Trustees for the benefit of the members. The investment strategy document is the “investment story” of your SMSF and must be reviewed at least once a year. You can create your own investment strategy very easily.

Each year your SMSF’s activities are overseen by a licenced independent Auditor and a tax return is lodged with the ATO. Supervision take care of these tasks for you. We do this by keeping your SMSF up to date on a day by day basis and then compiling all of your required documents for you.

With compliance taken care of, all you need to do is spend your time working on making as much money as you can on your investment strategy.